Work

All Projectspaze

Paze

SMP: Designed to fill in the gaps between paydays

To deliver honest financial products that improve people’s lives.

Challenge

Disheartened with the state of the payday lending industry in the UK, paze was founded on the premise of eliminating the dependency on short-term credit and encourage working people to save. Digging into the consumer lending industry, some consumers with full-time jobs were financially stressed struggling with their monthly cash flow. Many not having disposable incomes to resolve any unexpected spend, it would lead people to seek out high-interest, short-term credit solutions, which in some cases could leave them financially vulnerable. Paze is designed to help you improve your cash flow between paydays, by giving you access to your money as you earn it instead of waiting for your next payday. By increasing your available cash throughout the month, paze can help you avoid late payment fees, interest and bank charges and save more at the end of the month.

Solution

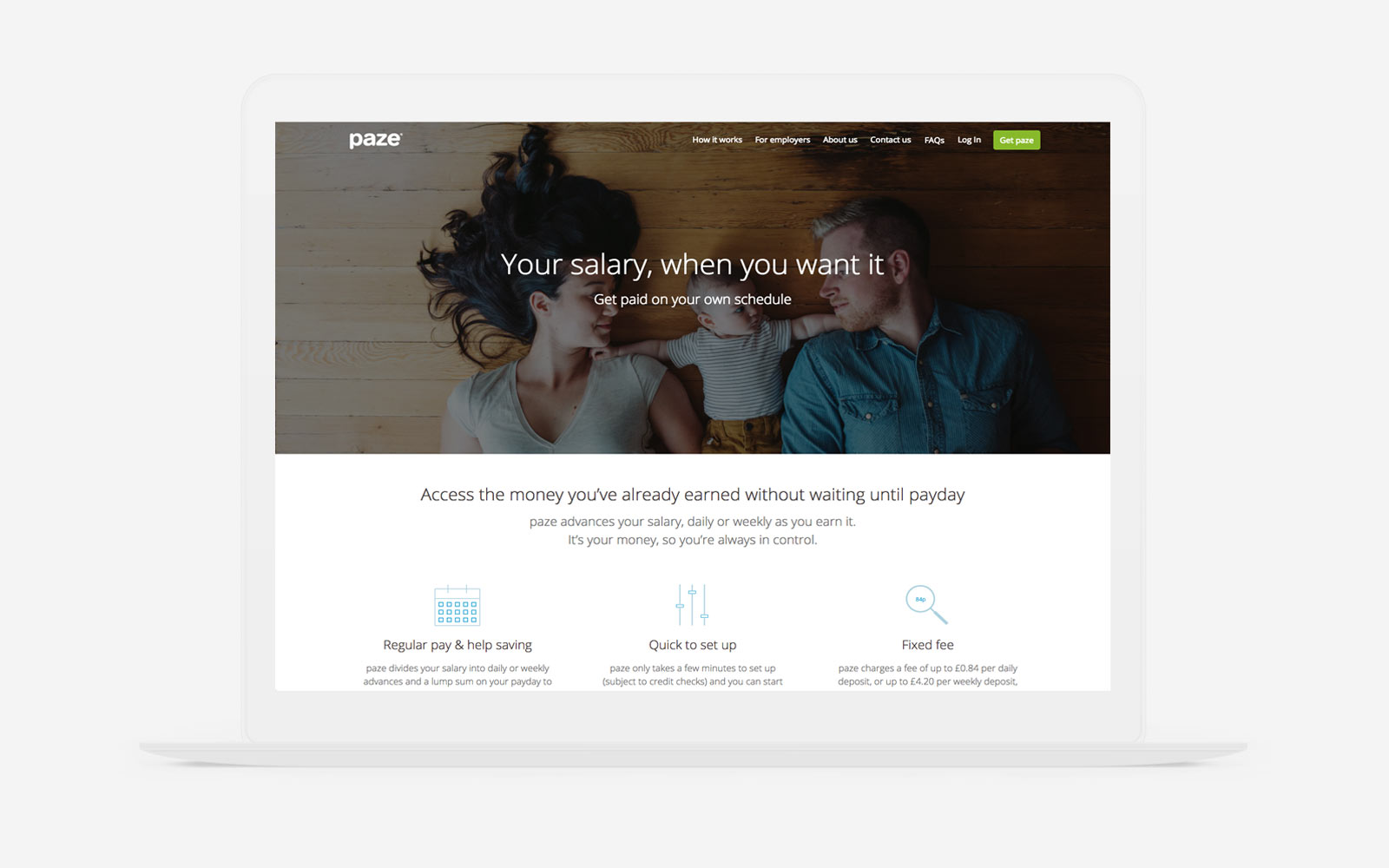

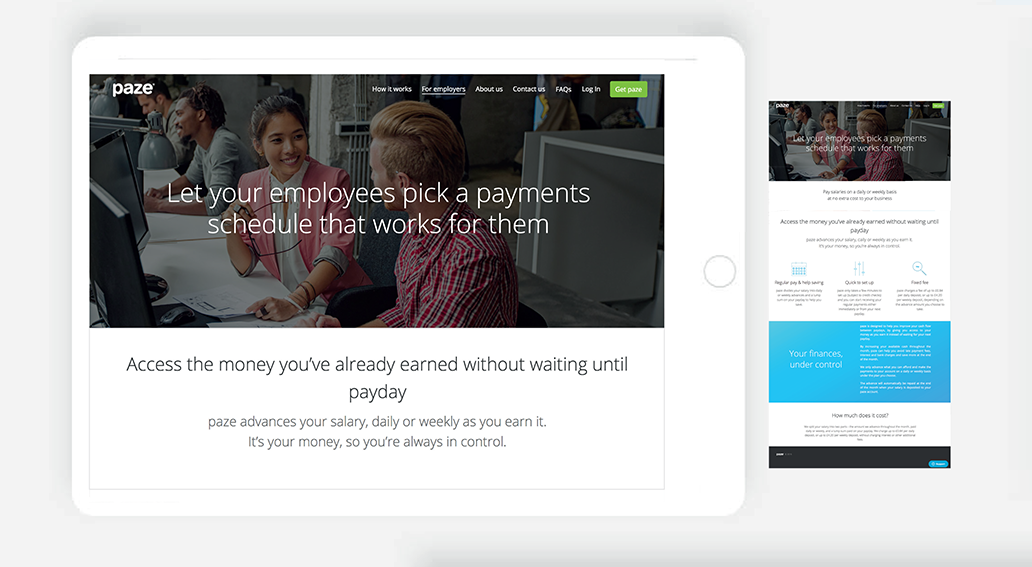

Working with paze to develop a holistic solution to customer finance. The website design reinforces what paze stands for, with consistent brand messaging that focuses on removing the stress of payday loans. The content of the paze site promotes financial control, using informative and straightforward language to safeguard its reputation as a pioneer in the finance industry. The innovative solution shows customers that there are better ways to manage their finances without payday loans.

The design elements included an articulate brand message, enforced by robust paze brand guidelines. The website, external campaigns, and internal applications all deliver to those guidelines, developing consistency and brand authority.

Included: brand essence, website brand, brand guidelines

www.paze.me